How Mortgage Broker Near Me can Save You Time, Stress, and Money.

Wiki Article

The Ultimate Guide To Scarborough Mortgage Broker

Table of ContentsThe Definitive Guide to Mortgage Broker In ScarboroughThe Single Strategy To Use For Mortgage Broker Near Me4 Simple Techniques For Mortgage Broker Near MeMortgage Broker Near Me Can Be Fun For AnyoneThe 9-Second Trick For Mortgage Broker In ScarboroughExcitement About Mortgage BrokerMortgage Broker Near Me Things To Know Before You Get ThisThe smart Trick of Mortgage Broker In Scarborough That Nobody is Talking About

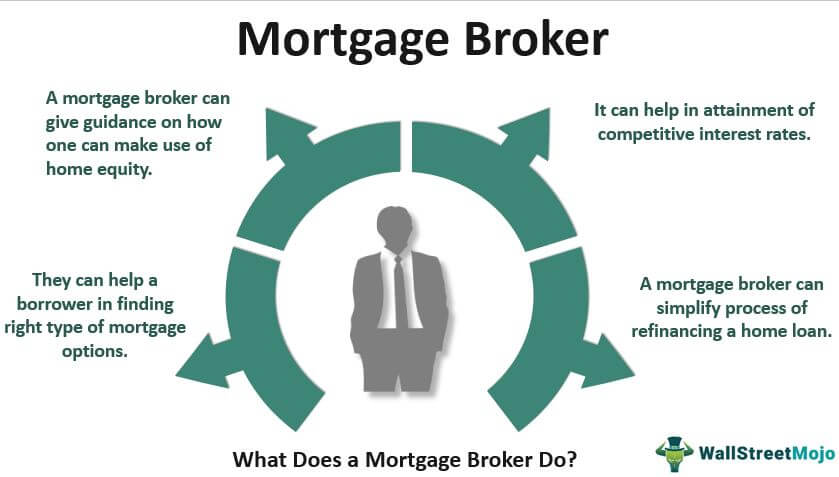

A broker can contrast car loans from a financial institution as well as a credit score union. A banker can not. Banker Wage A mortgage banker is paid by the institution, typically on a wage, although some institutions offer monetary incentives or bonus offers for performance. According to , her very first responsibility is to the institution, to see to it financings are appropriately safeguarded and the debtor is entirely qualified as well as will make the finance repayments.Broker Payment A mortgage broker stands for the consumer greater than the loan provider. His responsibility is to get the customer the ideal bargain feasible, despite the establishment. He is typically paid by the financing, a type of commission, the distinction in between the rate he receives from the loan provider and the rate he supplies to the borrower.

The Basic Principles Of Mortgage Broker In Scarborough

Jobs Defined Understanding the advantages and disadvantages of each could aid you decide which career path you desire to take. According to, the primary difference between both is that the bank home mortgage officer stands for the products that the bank they help deals, while a mortgage broker works with several lending institutions as well as functions as a middleman between the lending institutions and also customer.On the other hand, bank brokers might find the job ordinary eventually considering that the process typically continues to be the very same.

Some Known Incorrect Statements About Scarborough Mortgage Broker

What Is a Funding Policeman? You might recognize that locating a loan policeman is a crucial step in the process of acquiring your funding. Let's discuss what lending officers do, what understanding they need to do their task well, and whether lending police officers are the very best alternative for debtors in the loan application screening process.

Mortgage Broker In Scarborough Can Be Fun For Anyone

What a Finance Police officer Does, A funding policeman works for a bank or independent lending institution to help customers in requesting a car loan. Considering that several consumers work with funding officers for home loans, they are typically described as mortgage policemans, however many finance policemans aid debtors with other loans too.

A loan officer will consult with you and also review your credit reliability. If a car loan police officer believes you're qualified, then they'll advise you for authorization, and you'll have the ability to continue in the process of getting your loan. 2. What Car Loan Police Officers Know, Lending policemans have to have the ability to work with consumers and also local business proprietors, and they must have comprehensive knowledge about the sector.

The 6-Second Trick For Mortgage Broker In Scarborough

How Much a Financing Officer Costs, Some finance police officers are paid by means of payments. Home loan loans tend to result in the biggest compensations since of the size and also work linked with the loan, however commissions are typically a negotiable pre paid cost.Funding police officers recognize all about the many kinds of fundings a lender might use, and they can provide you guidance regarding the best alternative for you and also your scenario. Discuss your needs with your finance policeman.

All About Scarborough Mortgage Broker

The Role of a Finance Officer in the Screening Refine, Your lending police officer is additional reading your direct get in touch with when you're applying for a loan. You will not have to worry concerning regularly contacting all the individuals included in the home mortgage finance procedure, such as the underwriter, actual estate agent, negotiation lawyer as well as others, due to the fact that your financing policeman will certainly be the point of get in touch with for all of the included parties.Since the process of a funding deal can be a facility and also costly one, several customers like to deal with a human being instead of a computer. This is why financial institutions might have a number of branches they desire to offer the possible debtors in numerous areas who desire to fulfill face-to-face with a funding police officer.

Mortgage Broker Near Me for Dummies

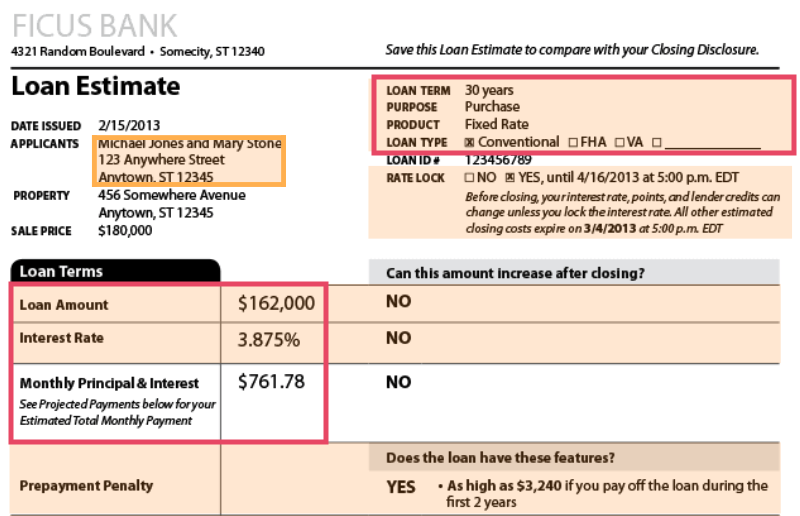

The Function of a Lending Officer in the Loan Application Refine, The mortgage application process can really feel frustrating, particularly for the new homebuyer. But when you collaborate with the best funding policeman, the process is actually pretty easy. When it involves using for a home loan, the process can be broken down right into 6 stages: Pre-approval: This is the stage in which you discover a lending policeman and obtain pre-approved.During the lending handling phase, your loan police officer will contact you with any concerns the lending cpus might have regarding your application. Your financing police officer will certainly after that pass the application on to the underwriter, who will certainly assess your creditworthiness. If the expert accepts imp source your loan, your lending officer will then accumulate as well as prepare the suitable finance shutting papers.

Mortgage Broker In Scarborough for Dummies

Report this wiki page